- STARTUPS WITH A PARTNER FIRST STRATEGY DON'T ATTACK INCUMBENTS. THEY "ATTACH"!

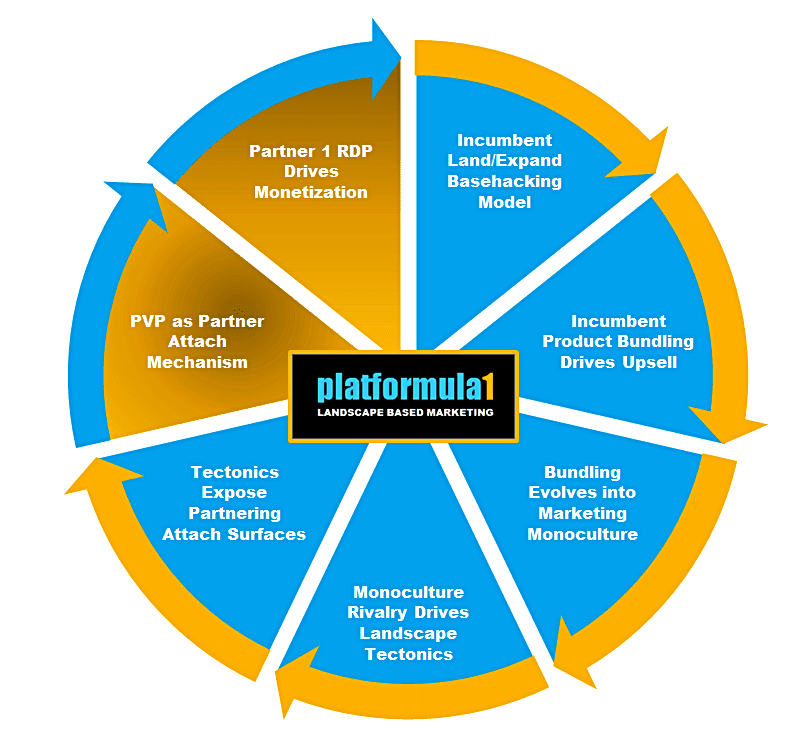

We call it Landscape Based Marketing (LBM).

LANDSCAPE BASED MARKETING (LBM)

PARTNER FIRST GROWTH FOR THE STARTUP 99%

There's a better, faster, cheaper way to build your tech startup. We call it Landscape Based Marketing (LBM).

In the digital jungle--aka the tech industry--the "landscape" is not some colorful logo map or static magic quadrant from an analyst firm. Never has been. The real landscape in tech is the active, pre-existing customer base and value-creating developer/partner ecosystems of incumbent vendors--Online and offline.

For startups focused on revenue development and operating self-sufficiency--vs. vanity metrics and the next VC check--incumbent vendor landscapes are living centers of strong market gravity--and forms of networked capital you can harness via Partner1st LBM. Incumbent vendor landscapes are characterized by their well-defined topography and non-stop rivalry, aka market tectonics. Simply put, incumbent vendor landscapes are alive--Even those bundle-everything B2B monocultures. These inherent properties of incumbent landscapes--Their discoverable ecosystem topography and active market tectonics--make them sticky attach surfaces for partner-advantaged revenue traction in both cloud-native & edge-native emerging markets.

For the Startup 99%--hardware, software, networking, & As-a-Service insurgents with tribal leadership & a "hunter" revenue marketing orientation--Here are the compelling benefits of LBM.

Piggyback on Incumbent Landscape Capital

Now there's a capital idea. What's "landscape" capital?

The paid customer base, developer ecosystems, and partner relationship networks of tech incumbents constitute forms of landscape capital that the Startup 99% can put to work. Platformula1 shows you how!

Reduce Over-Dependence on Venture Capital

It's about self-sufficiency, not endless "strategic finance"

With Partner1st LBM the Startup 99% prioritize operating self-sufficiency--not vanity metrics and the next VC check. As user marketing is misapplied in SaaS, XaaS, & IoT, startups have become over-dependent on VC funding.

Retain More Equity for Founders & Your Team

Control your startup's destiny where it counts the most

The Startup 99% are led by founders and their key hires, not VC dropped-in "operators" implementing the "growth" cargo cult du jour. By cutting dependence on VC cash & driving Partner1st self-sufficiency, LBM helps founders control what they create.

Rightsize Marketing & Sales Spend Forever

The burnapalooza of the Startup 1% is unsustainable

The misapplication of user marketing by startups drives marketing & sales spend through the roof. The unicorn Startup 1%--even in enterprise B2B--Burn 60/70/80% and more of revenue on sales & marketing red ink. LBM-driven startups burn dramatically less on sales & marketing, in the mid-20's percentage.

Ride Landgrab Economics in

Cloud-Native & Edge-Native

Your building block tech as next 'new stack' category

Enterprise digital transformation is underway, and many incumbents are driving this wave. IT environments are being modernized with cloud-native & edge-native building blocks. This creates new partnering opportunities for B2B/B2D startups. Platformula1 shows you how to use LBM as your new category GPS.

Grow Via Sticky Distribution on Incumbent Landscapes

Our TAO spells

Targets of Asymmetric Opportunity

Tech startups executing LBM grow via multimodal Partner @ the Core distribution. From HW/SW OEMs to partner APIs to SaaS pivots from direct-to-user models, we're fluent in partner-based market development for startups. And we help incumbents re-engineer their partner programs to capitalize on new partnering approaches.

SUBSIDIZED-USER GROWTH MODELS FAIL THE STARTUP 99%, MAKING THEM "WEAK & UNFOCUSED"

The Startup 99% need to detox from the "fake growth" cargo cult of the Startup 1%.

Attempts to apply "disruption theory", the "lean startup" model, the AARRR framework, & martech-based digital marketing "experimentation" can often be based on a false premise--That a downstream user is (and should be) the sole or fundamental unit of a tech startup's Revenue Design Pattern (RDP) and funnel development strategy. These disruption-centered AARRR user-funnel models are favored by the Startup 1%--I.E. that cohort of cash-infused, cash-burning "unicorns" whose VCs literally subsidize user adoption in their pursuit of a pre-emptive (aka blitzscaled) "winner-take-all". Think Uber--a "Silicon Valley startup" that burned $3Billion in losses in 2016 alone--And may have lost even more in 2017. The Startup 99%--Founder-led, emerging tech, new category startups with developer-friendly building block product models including open source, XaaS, API, & IOT--Should strive to detox from the high-burn, subsidized user marketing cargo cult. It's a death sentence for founders and death spiral waiting to happen to your startup when (not if) capital dries up. And the underlying "thought leadership" supporting the subsidized marketing cargo cult sets you up for failure. Here's what we mean.

1DISRUPTION THEORY HAS A HOLE IN IT

"Low cost" & "new market" are the official "2 footholds" of disruption thinking. Not so fast! There is a "3rd Foothold". Building block or "ingredient" startups that partner upstream with tech incumbents to gain access to their active base of customers, developers & channels drive big market landgrabs.

2THE LEAN STARTUP MVP FAILS CUSTOMERS

Highly satisfied paying customers are the lifeblood of the Startup 99%--Not the search for the next round of VC cash. But Lean Startup theory consistently treats early customers as crash test dummies--advocating they be served not ready for prime time products under the mantra of market "learning".

3AARRR DRIVES SPEND THROUGH THE ROOF

The AARRR growth framework --built around 'freemium' B2C offerings--progressively turns sales/marketing budgets into capital sinkholes, making startups weak & unfocused. A generation of App & SaaS startups has little or no institutional memory of partner based revenue development inside incumbent ecosystems.

4EXPERIMENTS DO NOT EQUAL STRATEGY

"Martech" vendors sell tools to startups chasing user-based models. They evangelize user experimentation, i.e. growthhacking, to drive demand for their own martech products. This is smart for them. But not you. Experimentation is not necessarily landscape-grounded strategy. It could be a red flag you may not have one.

FOR THE STARTUP 1%, VC-SUBSIDIZED USER ADOPTION IS THEIR "UNFAIR ADVANTAGE" .

For the overwhelming majority of tech startups, user engagement strategy and revenue strategy are NOT the same thing. Not even close. Monetizing users is expensive. The marketing and sales investment is front-loaded--especially for direct SaaS & App startups. This front-loaded spend is rationalized by VCs based on the myth of "lifetime customer value" or LTV. But realizing LTV in practice often pre-supposes your business can lose money indefinitely, i.e. long enough to capture that "lifetime" value. Tier 1 VCs have openly admitted they subsidize cash-burning user adoption if they think a given business is a candidate to be "blitzscaled" into a pre-emptive "winner take all". Red ink Uber is the poster child of this trend substituting "strategic finance" for strategic marketing.

In 2016, Uber lost $3Billion & is on track to potentially lose more in 2017. Think about that. It adds up to more than 1000 $6+Million Series A investments in the Startup 99% that Uber investors burned in subsidized user adoption in just 2 years.

The takeaway. It is a mistake for the Startup 99% to imitate or follow the marketing lead of the Startup 1%, who gain the bulk of competitive advantage from VC-subsidized adoption. The Startup 99% need another path to revenue, growth, and landgrab market dominance.

LBM: THE GROWTH MODEL FOR THE STARTUP 99%

"Act according to the situation & make use of external factors." Sun Tzu, Art of War

Landscape Based Marketing (LBM) is how B2B and B2D tech startups "make use of external factors"--i.e. the pre-existing customer, developer, and partner capital of incumbents--to compete and win in 21st century tech markets. LBM practitioners embrace indigenous landscape asymmetry and see incumbent centers of market gravity--and even entrenched big tech monocultures--as attach surfaces for new category emergence and startup growth. This is the Partner1st model that drove the dominance of Microsoft in its startup phase. LBM helps the Startup 99% detox from cargo cult marketing models--e.g. the misapplication of B2C digital marketing to B2B and B2D--and build Partner Viable Products (PVP) that dramatically reduce marketing and sales spend, while scaling your business via sell-through partnerships inside incumbent ecosystems.

1LBM TOPOGRAPHY: GET GROUNDED

LBM practitioners "Get Grounded" on the landscape topography of incumbents. They leverage incumbent relationship networks as an "attach surface" for Partner1st growth, and see topography as a form of pre-existing capital or natural resource for the development of Partner Viable Products (PVP).

From the standpoint of LBM, landscape topography is comprised of active partner/developer ecosystems, installed customer base "ecozones" and associated product-centered "ecoregions" of incumbents. These incumbent vendor centers of gravity provide new category landgrab opportunities for startups that cultivate & execute around a Partner1st mindset.

Platformula1's "9 Grounds of LBM" partner development framework helps guide cloud-native and edge-native startups as they begin their LBM journey. Our "9 Grounds" approach--which we apply to client engagements via our LBM QuickStart support service--helps resource-constrained startups (and under-funded enterprise digital initiatives) systematically piggyback their revenue efforts on the pre-existing landscape capital of tech incumbents.

2LBM TECTONICS: GET ATTACHED

Landscapes are alive. The landgrab economics & continuous "cage fight" rivalry between & among tech monocultures drives the market tectonics of landscapes. Landscape tectonics expose rich incumbent attach surfaces, i.e. who, what, when, where, why and how your startup can "Get Attached", i.e. close sticky revenue partnerships with incumbent vendors with dueling agendas.

Monoculture rivalry reveals product line gaps, point category overlaps, key programs, & partnering 'big signals' that enable you to forge multimodal distribution relationships with targets of asymmetric opportunity (TAO)--I.E., tech incumbents who see your cloud-native & edge-native digital building blocks as the next emerging category "ticket to the game" in their continuous rivalry with each other.

We'll teach your hunter/evangelist sales lead how to read landscape tectonics to align with the growth programs & relationship networks of incumbents for your startup. And with LBM Frame, we'll help you create the positioning, content and new/emerging category value proposition needed to stay attached when copycats come calling.

3LBM TRACTION: GET PAID

LBM practitioners "Get Paid"--i.e. monetize their building block innovation--Inside of or attached to the apps, clouds, networks, systems, solutions, devices, and experiences that incumbents deliver to their users. This digital ingredient sell-through growth model scales startups faster than user-based marketing--or sub-optimized ABM (account based marketing) initiatives that are over-dependent on user funnels. Targeted account-based selling is much more effective when its "front end" funnel development is based on LBM mindset and Partner1st Revenue Design Patterns.

LBM enables startups to design-in multiple distribution & monetization modalities for their their cloud-native or edge-native innovation--Providing maximum revenue traction on incumbent landscapes for true Partner Viable Products (PVP).

LBM practitioners reject marketing cargo cults, and do not blindly follow SaaS "subscription economy" & LTV thinking into the ditch. Platformula1 helps you craft a Partner1st Revenue Design Pattern (RDP) that leverages elastic usage-based & white label pricing models that turn "non-strategic" product procurement into a sticky, long term partnerships for your team.

WHY LBM WORKS

LBM ALIGNS THE STARTUP 99% WITH THE "BASEHACKING" AGENDAS OF ENTERPRISE TECH INCUMBENTS

Enterprise tech incumbents are basehackers with Land/Expand account sales models that naturally & continuously drive landscape tectonics & startup opportunity.

LET'S BREAK IT DOWN

TECH INCUMBENTS HAVE WELL-DEFINED PRODUCT, SALES, AND CATEGORY EXPANSION MODELS & PROCESSES

Startups that understand and align with incumbent models and processes can leverage them.

Here's what the Startup 99% need to know about incumbents to break completely with cargo cult startup models and creatively undertake their Partner1st LBM journey.

INCUMBENTS ARE BASEHACKERS.

THEY "LAND & EXPAND"

Tech incumbents sell one thing and upsell many things. They land and expand.

The term we use to describe this continuous process of upselling to existing, i.e. "installed base" customer accounts, partner networks, and 3rd party developers is basehacking. Incumbent tech basehacking is a form of "whole ecosystem strategic account management" through which incumbents have built ongoing customer, partner & developer networks the Startup 99% can engage--Symbiotically and with permission through Partner1st LBM.

LAND/EXPAND BASEHACKING DRIVES INCUMBENT PRODUCT BUNDLING

Bundled product families, frameworks, & fabrics underpin incumbent Land/Expand sales models.

Simply put, incumbent basehackers orchestrate their value proposition across multiple categories, and continuously broaden their value prop into adjacent and new categories, creating a true "center of market gravity". They are always on the hunt for new differentiation--and acquire and partner with startups to gain that differentiation. "Bundling" is also how tech incumbents resist commoditization of their value prop by VC-funded, subsidized-adoption "disruptors" in the Startup 1%.

PRODUCT BUNDLING MORPHS INTO MARKETING "MONOCULTURE"

When you multiply "Land/Expand" X "Product Bundling" over time, what emerges is a branded monoculture marketing model.

Monoculture is now the main trend in tech, in which "off the shelf" or "out of box" cross-category bundled product/service sets from Vendor A compete with bundled product/service sets from Vendor B. Legacy enterprise monocultures serve as centers of market gravity attracting developers and partners seeking to piggyback on, and profit from, a specific monoculture agenda. While the Startup 1% seek venture capital to "unbundle" and disrupt incumbents, the Startup 99% know that there is much more upside to partnering with incumbents to gain permissioned access to their ecosystems, ecozones, and ecoregions.

INCUMBENT MONOCULTURE RIVALRY TRIGGERS LANDSCAPE TECTONICS

It is a mistake to think that 2-dimensional "disruption" drives markets. Monocultures-at-war drive markets.

Tech monocultures are responsible for the lion's share of growth action in tech markets. Think cloud wars, mobile wars, enterprise data center wars, and soon the "edge" wars. Tech monocultures are also tipping into traditionally "non tech" markets, e.g. vehicles, expanding opportunity for a new generation of Partner1st startups at the in-motion "elastic edge". And as tech monocultures expand into traditionally non-tech markets (e.g. Amazon's buyout of Whole Foods) tectonics intensify and new partnering opportunities for the Startup 99% present themselves.

LANDSCAPE TECTONICS EXPOSE NEW ATTACH SURFACES FOR STARTUP PARTNERING

When monoculture tectonics intensify, LBM startups think Attach, not Attack. They "Get Grounded"

New categories and lucrative partnering opportunities continuously emerge in the bundled product family gaps of incumbents. These gaps can be addressed by both pure play tech startups and new enterprise digital transformation initiatives that seek to "productize" internal processes (e.g.how banks are pursuing "fintech"). LBM practitioners stay tuned for opportunity "big signals", and act accordingly when these gaps are identified. Because of cargo cult marketing "thought leadership", the study of landscape tectonics by industry analyst firms is weak and relatively shallow--As is the idea of "Attach vs Attack" as a strategic conversation inside the startup marketing community. This is what happens when "strategic finance" (aka subsidized user marketing) replaces strategic marketing in startup land.

PARTNER VIABLE PRODUCTS (PVP) DRIVE SYMBIOTIC ATTACH STRATEGY

When Partner1st LBM startups identify new category gaps, they build Partner Viable Products.

Partner Viable Products are attachable "digital building blocks" consumed by incumbent partners and their extended developer networks inside of or adjacent to the apps, clouds, networks, systems, solutions, and experiences that incumbents deliver to their customers. When one reviews 2016 and 2017 tech IPOs, it is clear that those startups that pursued a Partner1st model have much more profitable businesses with much lower marketing and sales spend. This is major data point for venture-funded SaaS startups with direct to customer models based on freemium user funnels. These companies need to get busy and "xaasify" their startup.

A PARTNER1ST REVENUE DESIGN PATTERN (RDP) FUELS YOUR EMERGING CATEGORY LANDGRAB

Startups with a winning PVP secure their path to emerging category leadership with a Partner1st Revenue Design Pattern (RDP)

It is increasingly clear to many startups that the direct-to-customer subscription SaaS model--rationalized by the concept of LTV--fails the Startup 99%. To succeed with an LBM-focused strategy, the Startup 99% leverage "creativity more than cash". They don't just build a "platform" and then burn obscene amounts of VC cash to "drive user adoption". They build a unique platformula or Partner1st Revenue Design Pattern that rewards incumbent partners for adopting and marketing your Partner Viable Product. A solid RDP is a basehacker "ticket to the game", enabling incumbents to immediately win in their pre-existing customer, partner, and developer networks--And triggering a landgrab adoption pattern for your PVP.

LANDSCAPE BASED MARKETING SERVICES

IT'S A DIGITAL JUNGLE OUT THERE.

CAPTURE THE LION'S SHARE OF GROWTH WITH LBM.

Wherever your startup is in its growth journey, LBM can help you go from "disruptive attack" to symbiotic "attach".

If your startup is brand spanking new, make LBM strategy the nucleus of your planning, and avoid the high burn user-marketing investments and ungrounded disruption mindset popular with the cargo cult Startup 1%. Or if your startup launched as a direct-to-user SaaS or App vendor, we can help you untangle that VC-dependent model in favor of a low burn, partner-advantaged XaaS or API-as-a-Product model.

And if you're an incumbent player looking to re-invent your partner ecosystem from the inside out--LBM can help you attract the cream of the startup crop to align with your value prop and land/expand growth agenda. And finally, if you need help building the emerging category thought leadership you need to win on incumbent landscapes, we've got your back.

LBM QuickStart: For the Startup 99%

Get Grounded. Get Attached. Get Paid.

Landscape Based Marketing (LBM) is a Partner1st growth system for cloud-native and edge-native building block startups--i.e. the Startup 99%.

Play or get played. That's the way it works in tech startup land. But the vast majority of startups--the Startup 99%--have gotten "played" by relying on the high cash-burn, fake growth cargo cult of the Startup 1%. This cargo cult sets up the Startup 99% for failure by mistakenly focusing on attacking incumbents instead of forging partnerships with them--in their customer base and developer/partner ecosystems, i.e. the "landscape" they occupy.

Platformula1 knows from experience that the Startup 99% overwhelmingly benefit by building a landscape-grounded startup with Partner Viable Products (PVP) and a Partner1st Revenue Design Pattern. This model drives self-reliant growth at the lowest cost of sales/marketing.

Platformula1 uses its battle-proven "9 Grounds of LBM" framework to provide a structured market development model that drives LBM traction for bootstrapped and angel-backed startups with either cloud-native or edge-native innovation. Our LBM Quickstart is incredibly affordable for the Startup 99%. And if we love your emerging category more than we love our own children, we'll be very accomodating.

Reach out to us using the form below and let's creatively apply LBM to your startup.

LBM BaseHacker: For Incumbents

Partner Ecosystem Re-invention

Incumbent tech B2B basehackers with land/expand strategic selling models have a once-in-a-generation opportunity to re-invent their partner ecosystems-- And win big in the ongoing cloud-native and edge-native landgrabs. Landscape Based Marketing (LBM) mindset and new kinds of partner programs are the key.

Don't paint your partner marketing organization into a corner by over-relying on legacy "channel" programs with costly, pay-to-play MDF or high maintenance subsidized selling. In the age of "anything as a service" or XaaS, you'd be missing out. LBM enables your organization to begin leveraging your new as-a-service products to build new partner-advantaged revenue engines.

For example, add-on partner marketplaces pioneered by multiple incumbents have served as partner magnets bringing new value to an incumbents' installed base of customers and pre-existing ecosytem allies, while monetizing your customer landscape in new ways.

In the case of leading cloud incumbents, these kinds of new partner initiatives have supercharged growth and adoption inside the installed base, while closing product gaps in existing portfolios.

Have your lion reach out to our lion below.

LBM Frame: For the Startup 99%

Emerging Category Positioning & Content

New categories are continuously emerging inside of cloud & edge developer ecosystems. The Startup 99% require category-framed content creation to fuel Partner1st revenue programs.

What emerging category innovators need to win is not more cotton candy hypecycle click bait--But multi-dimensional thought leadership that frames their innovation & building block goodness for rapid partner adoption--By incumbents in search of the next big differentiator. Thought leadership is not about the corporate ego trip but the partner "eco trip" of how your innovation plays inside of, and attached to, incumbent landscapes.

And direct SaaS players---once entirely focused on downstream user adoption---are pivoting to Partner1st XaaS and now monetize upstream developer integrations and embedded partnerships by exposing their offerings and data as plug/play PVPs, e.g. API-as-a-Product or white label XaaS. This pivot requires a different kind of messaging and positioning of your value proposition than direct user CTA content.

We help you craft the messaging, content, & category thought leadership you need to frame your digital building block services as must-have capabilities for alpha developers and incumbent ecosystem partners.

Reach out below or and learn to speak lion to the other lions. We'll translate for you.

LBM XaaSify: For SaaS Pivots

SaaS-to-XaaS Transformation via LBM

Without continuous infusions of venture capital, the direct-to-customer SaaS model is difficult to sustain, let alone drive to GAAP profitability. Platformula1 recommends that direct SaaS startups take out an insurance policy against failure, and "XaaSify" their startup through Partner1st LBM.

Software may be "eating the world", but direct-to-customer SaaS is eating the income statement--regularly burning 60/70/80 percent of GAAP revenue (or more) on sales/marketing spend. Direct SaaS has extremely low sales efficiency and is bringing back many forms of non-permissioned marketing, including invasive telesales to users that "churn out" of free or freemium offerings. Why reinvent the wheel with user-based "sell to" when partner-based "sell through" powers growth at a dramatically lower marketing/sales spend.

Platformula1's XaaSify service helps SaaS players pivot their direct model to a Partner Viable Product (PVP) with multiple partner-based distribution options and a Partner1st Revenue Design Pattern.

Startups that follow this approach stand in dramatic contrast to the high burn marketing and sales model of direct-to-customer SaaS "disruptors".

We'll help your "as a service" innovation win big in the company of lions. Just contact us using the form below.

Win the Lion's Share of Growth in Your Emerging Category with Landscape Based Marketing (LBM)

If you've founded a tech startup, it's time to stop attacking and start attaching. Stop chasing the next round of capital and the FOMO "growthhack" of the moment. Instead, detox from the user marketing cargo cult and leverage the "landscape capital" of incumbents via Partner1st LBM. We'll show you how to piggyback your new category startup on the ecosystems, ecozones, and ecoregions of tech leaders. Activate landgrab economics now with Partner1st LBM!

ABOUT PLATFORMULA1

We've got a thing for market asymmetry and landgrab economics. So reach out, and run in the company of lions.

Platformula1 Provides Free Cargo Cult Marketing Detox On Demand

Platformula1 is unique in our assessment that there is lost institutional memory in Silicon Valley venture incubators & accelerators relative to the power of incumbent landscapes to drive Partner 1st growth for startups--And that recovering and making actionable this lost institutional memory provides compelling value to the bootstrapped Startup 99%.

That's our mission. Evangelizing a better, faster, cheaper "path dependency" for startup traction based on symbiotic partnering with incumbent basehackers.

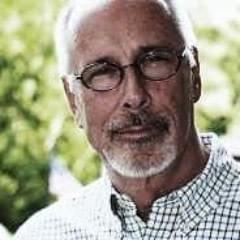

Joseph Bentzel

Founder, Senior Project Lead, Platformula1

Author of cult classic Asymmetric Marketing, Joe began his career at AT&T in their earliest initiatives with online services. Joe has served as either formal CMO or transitional turnaround CMO at multiple hardware, software, networking, and "as a service" startups.

As senior consultant at Platformula1, he has served startups and incumbents across scores of B2B, B2D, and B2C categories. Joe is personally involved in every project.

Landscape Asymmetry = Landgrab Opportunity

for Partner1st Startups

11 years later it's still evergreen content, and the theoretical foundation of Landscape Based Marketing (LBM)

“It is (the) creative cooptation of the market power of incumbent market leaders . . . that should be the goal of every asymmetric marketer at every stage of the evolution of your business strategy.”

Platformula1 Blog

For LBM practitioners, including incumbent basehackers. Intermittent dot connecting well worth the wait.

June 9, 2019February 27, 2018January 30, 2018Check Out Platformula1 on Medium

Copyright 2010-2023, All Rights Reserved.